1. Market Overview

Fiber cement board is a high-performance building material made from cement, cellulose fibers (such as wood pulp), and mineral fillers. It offers properties such as fire resistance, waterproofing, and weather resistance. In Russia, due to the growth of the construction industry and stricter fire safety regulations, the fiber cement board market has shown steady growth in recent years.

1.1 Market Size

Market size in 2023: Approximately $250–300 million

Expected CAGR (2024–2030): 5%–7%

Major application sectors:

Residential construction (40%)

Commercial construction (30%)

Industrial construction (20%)

Others (10%, e.g., decoration, renovation projects)

2. Market Drivers

2.1 Growth in the Construction Industry

The Russian government promotes housing construction programs (e.g., the “2024 Housing Plan”), boosting demand for building materials.

Rapid development of commercial real estate in major cities like Moscow and St. Petersburg increases the use of fiber cement boards for facades, partitions, and decorative purposes.

2.2 Stricter Fire Safety Regulations

Russian construction standards (GOST) impose strict requirements on fire-resistant materials, making fiber cement boards (Class A fire resistance) a preferred choice.

Increased demand for fireproof materials in public buildings, hospitals, and schools.

2.3 Substitution of Traditional Materials

Gradually replacing gypsum boards, PVC panels, and wood due to superior durability, moisture resistance, and frost resistance (suitable for Russia’s cold climate).

2.4 Import Substitution Policy

Due to Western sanctions, Russia encourages domestic production to reduce reliance on European imports.

3. Competitive Landscape

3.1 Key Domestic Manufacturers

LATO – Russia’s leading fiber cement board producer, supplying products for interior and exterior walls.

Cembrit Russia – A Nordic brand with local production, specializing in high-end fireproof boards.

Eternit Russia – Produces asbestos cement boards but is gradually shifting to asbestos-free fiber cement boards.

3.2 International Brands

James Hardie (Australia) – A global leader in fiber cement boards, entering the Russian market via imports.

Nichiha (Japan) – High-end decorative fiber cement boards used in commercial projects.

China National Building Material (CNBM) – Competitive pricing, gaining market share in recent years.

4. Price Trends

Standard fiber cement board (6mm thickness): $5–10/m² (domestic brands are cheaper)

High-end fireproof/decorative boards: $15–30/m² (dominated by imported brands)

Price influencing factors:

Fluctuations in raw material costs (cement, fibers)

Logistics and tariffs (higher prices for imported products)

Localized production reduces costs

5. Consumer Preferences

Residential market: Prefers economical fiber cement boards for facades and balconies.

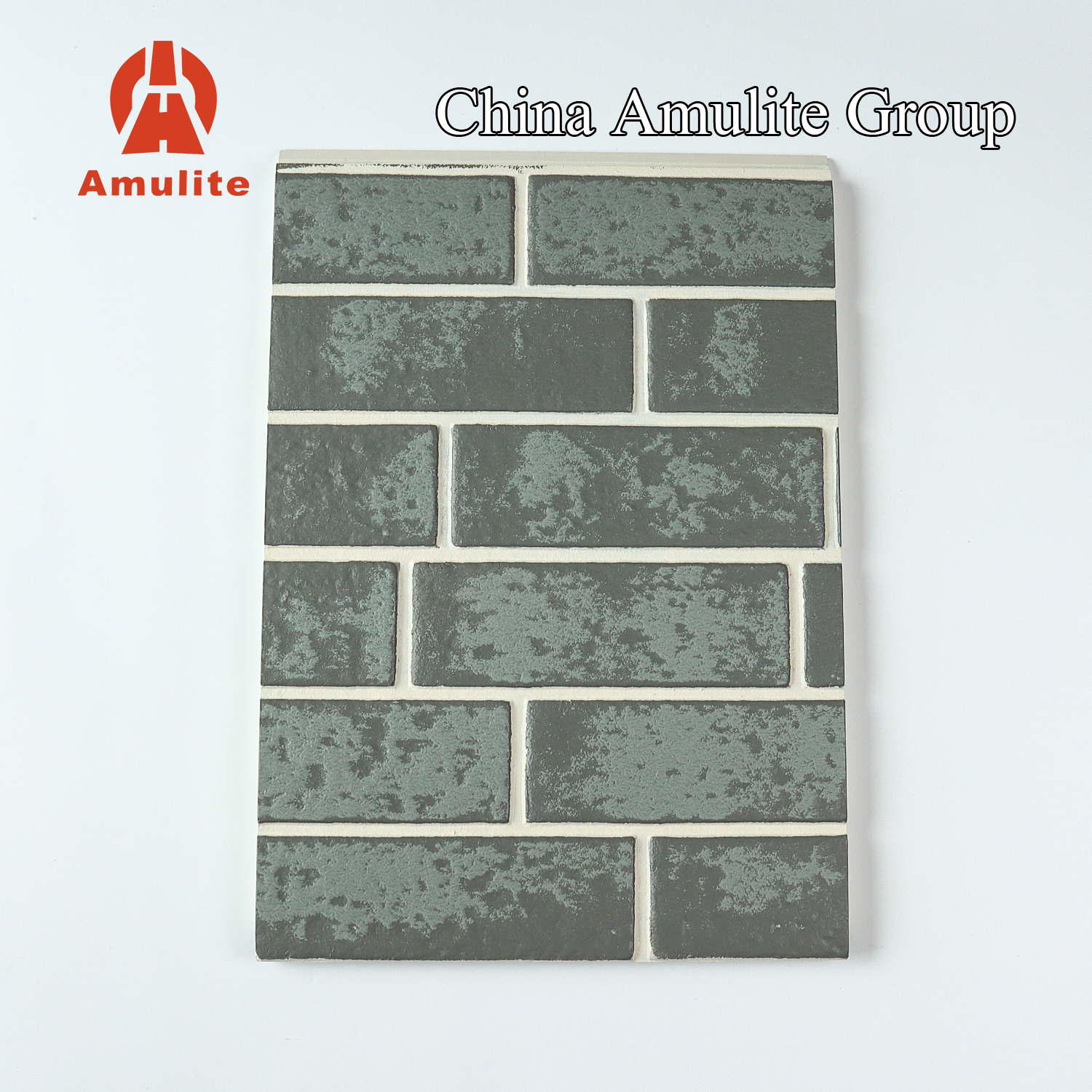

Commercial market: Favors high-end fireproof and decorative boards (e.g., wood grain, stone-effect finishes).

Industrial market: Prioritizes durability and moisture resistance for warehouses and factories.

6. Supply Chain and Distribution Channels

Raw materials: Russia has sufficient cement supply, but some fibers (e.g., cellulose) rely on imports.

Distribution channels:

Building material supermarkets (e.g., Leroy Merlin)

Direct procurement by construction contractors

Online platforms (Wildberries, Ozon)

7. Market Opportunities

✅ Government infrastructure projects: Demand growth from Far East development and Moscow urban expansion.

✅ Green building trends: Fiber cement boards are eco-friendly and recyclable, aligning with sustainability trends.

✅ Import substitution opportunities: Domestic companies can expand production to replace European brands.

8. Challenges and Risks

⚠ Impact of economic sanctions: Restrictions on imports of certain raw materials (e.g., specialty fibers).

⚠ Insufficient domestic capacity: High-end products still rely on imports, leading to supply chain instability.

⚠ Price-sensitive market: Low-cost gypsum boards and PVC panels still hold a share of the market.

9. Future Outlook (2024–2030)

Expected annual growth rate: 5%–7%

Key growth areas:

Fireproof building materials (mandatory Class A standards)

Decorative fiber cement boards (stone, wood grain effects)

Modular construction (demand for quick installation)

Conclusion

The Russian fiber cement board market is driven by construction growth, fire safety regulations, and import substitution policies, presenting an optimistic outlook. Domestic manufacturers have opportunities to expand market share but must enhance high-end production capabilities to compete internationally.

Post time: Jun-03-2025